JUNE 1, 2017: Family Office & Private Equity Dealmakers Breakfast Series

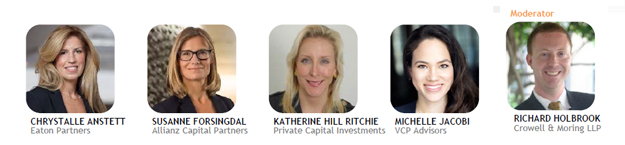

LIMITED PARTNERS & THE FUNDRAISING ENVIRONMENT

Fundraising for Alternative Investments and Private Equity Funds in particular is in a unique market environment. LPs committing larger sums to fewer funds, and smaller and newer funds still find are finding it more difficult to raise capital. The percentage of funds raised in the $250 million to $1 billion range has fallen to about 26% of overall fundraising, down from 35% in 2010. In many cases, the relatively few funds that do get capitalized are industry‐specific and have carved out niches for themselves in sectors or markets less exposed to record valuations. In addition, LPs are increasingly looking for direct investments and co‐investment opportunities.

Join the conversation on June 1, 2017 as the Family Office & Private Equity Dealmakers Breakfast Series addresses the main issues pertaining to “Limited Partners & the Fundraising Environment.” The Family Office & Private Equity Dealmakers Breakfast Series programs are exclusive and by invitation only, focused on senior‐level professionals from private equity firms and family offices.

Held 8:30 – 10:30 AM at Crowell & Moring LLP

590 Madison Avenue, 22nd Floor

New York, NY 10022

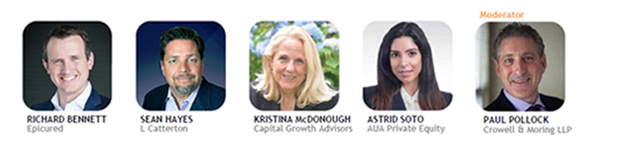

APRIL 6, 2017: Family Office & Private Equity Dealmakers Breakfast Series

PRIVATE EQUITY IN HEALTH, FITNESS & WELLNESS

The past few years have seen many private equity firms invest in an array of fitness, organic food and other companies active in “Health, Wellness & Fitness.”

Join the conversation on April 6, 2017 as the Family Office & Private Equity Dealmakers Breakfast Series addresses the main issues pertaining to “Private Equity in Health, Fitness & Wellness.” The Family Office & Private Equity Dealmakers Breakfast Series programs are exclusive and by invitation only, focused on senior‐level professionals from private equity firms, family offices and institutional investors.

Held 8:30 – 10:30 AM at Crowell & Moring LLP

590 Madison Avenue, 22nd Floor

New York, NY 10022

DECEMBER 8, 2016 | WALL STREET SERIES | ECONOMIC & MARKET OUTLOOK 2017

Economic forecasts envision another year of moderate growth in 2017. U.S. GDP growth is likely to remain subdued and inflation will likely edge higher due to technical reasons but is likely to remain at historically low levels. Persistent global disinflation is likely to continue to anchor monetary policy at accommodative levels. Cautious Fed hikes amid macro uncertainty, Euro-area growth acceleration and policy easing and managed growth deceleration in China will also affect the U.S. economy. The macro environment remains equity friendly, but risk-reward in stocks to deteriorate, especially in the U.S.

Join the conversation on December 8, 2016 with Crowell & Moring and a senior-level panel of economists and market strategists to discuss the issue of “Economic & Market Outlook 2017.”

Held 8:30 – 10:30 AM at Crowell & Moring LLP

590 Madison Avenue, 22nd Floor

New York, NY 10022

For more information & to register, please click here

Contact: Stephen Kimmerling, Crowell & Moring, 212-895-4234, skimmerling@crowell.com or Ron Idra, Polaris Group, 917-658-7304, ri@polarisgroup-ags.com

EQUITY CAPITAL MARKETS | IPO Bootcamp for Offshore Companies

The Wall Street Series is a series of meetings in which NYC’s financial executives conduct high level discussions focusing on solutions‐based approaches to today’s most pressing industry challenges. The programs are exclusive and by invitation only, focused on senior‐level professionals active in alternative investments (hedge funds, private equity, venture capital), bankers and institutional limited partners, including family offices. Held at Pepper Hamilton, LLP.

NYC ALUMNI | LP’s AND THE FUNDRAISING ENVIRONMENT

Fundraising for Alternative Investments and Private Equity Funds in particular is in a unique market environment. Limited Partners are committing larger sums to fewer funds, and smaller and newer funds still find are finding it more difficult to raise capital. The percentage of funds raised in the $250 million to $1 billion range has fallen to about 26% of overall fundraising, down from 35% in 2010. In many cases, the relatively few funds that do get capitalized are industry‐specific and have carved out niches for themselves in sectors or markets less exposed to record valuations. In addition, Limited Partners are increasingly looking for direct investments and co‐investment opportunities. Held at Foley & Lardner LLP

PRIVCAP GAME CHANGE | CONSUMER & RETAIL

Privcap Game Change: Consumer & Retail offered networking and learning opportunities centered on investment opportunities and the future of a highly disrupted industry. How are GPs helping legacy consumer-facing companies transform themselves to better compete in a digital era? How are institutional investors co-investing in consumer deals? How are early-stage and growth investors identifying fleet-footed disruptive companies? What major demographic, economic and technological trends will change the game for consumer & retail over the next 10 years?

WALL STREET SERIES | STATE OF THE HEDGE FUND INDUSTRY

Hedge fund AUM fell in 2015 below US $3 trillion for the first time since 2014, as investors exited hedge funds due to lackluster performance and high fees. Investors removed US$20 billion from hedge funds in 2Q16 alone, the largest outflow since prior crisis periods of 2008. The Wall Street Series addressed the main issues pertaining to “The State of the Hedge Fund Industry.” The Wall Street Series programs are exclusive and by invitation only, focused on senior-level professionals active in alternative investments (hedge funds, private equity, venture capital) and institutional limited partners, including family offices. Held at Wells Fargo, 150 E. 42nd Street

FAMILY OFFICE & PRIVATE EQUITY DEALMAKERS BREAKFAST | PRIVATE EQUITY IN FINTECH

Discussion on the main issues pertaining to private equity in the Fintech sector. Held on October 6th at the Offices of Crowell & Moring

EAST COAST FAMILY OFFICE CONFERENCE

More than 200 Single Family Office Executives and Ultra High Net Worth Family members, representing more than $100 Billion under management, usually take part. Keynote Speaker for this year’s conference was Mr. Sam Zell, Chairman of Equity Group Investment.

NYC ALUMNI SERIES | ENTREPRENEURS & RAISING VENTURE CAPITAL FINANCING

Foley & Lardner has created a series for NYC alumni of UC Berkeley, Harvard University and Stanford University for the firm to develop important relationships within the alumni communities of these three universities. Foley & Lardner is looking to establish significant relationships in the venture capital and early-stage tech community. Held September 22, 2016 at the law firm of Foley & Lardner.

WALL STREET SERIES | FAMILY OFFICES & DIRECT PRIVATE EQUITY TRANSACTIONS

Privcap, ACG and the Council on Foreign Relations (Foreign Affairs) bring together a distinguished panel of family office groups that are active in direct private equity investments. Held September 8, 2016 at the law firm of Pepper Hamilton.

BRYANT PARK LUNCHEON

Private lunch with 8-10 senior-level professionals at Bryant Park Grill. The Bryant Park Luncheon series are held for a NYC-based investment bank looking to establish significant relationships with private equity funds and family offices. The lunches are on a quarterly basis with 8-10 people active in the deal community, from PE funds, family office groups, bankers, limited partners, companies.

REAL ESTATE INVESTMENTS FOR FAMILY OFFICES

Join top family offices & HNWI who invest in real estate and those who are interested in learning more of the opportunities in this field, for a day of networking and insight from some of the biggest names in the US and global real estate industry. Held September 15th at Herrick Feinstein.

Speakers included:

Mr. Tal Kerret, President, Silverstein Properties

Mr. Jason Greenblatt, Executive VP & Chief Legal Officer, the Trump Organization

Mr. Ofer Yardeni, Chairman & CEO, Stonehenge

Mr. Kent Swig, President, Swig Equities

Mr. Moshe Rosenbaum, MFR Equity

Ms. Toby Moskovits, CEO, Heritage Equity Partners

Mr. Louis Hanna, Corigin Family Office

Ms. Wendy Craft, Executive Director & COO, The Gonzalez Family Office